The new USDA Outlying Innovation Mortgage system, also known as this new OneRD Be certain that Mortgage Step, has the benefit of help to smaller than average large organizations from inside the rural communities across the The usa. Introduced because of the You.S. authorities from Service away from Farming, it versatile loan system was developed to help with credit getting rural advertisers towards needs regarding protecting and you may starting operate in the rural areas and you will improving monetary possibility. The latest Outlying Creativity Financing program works by taking USDA-recognized mortgage claims to help you loan providers so you’re able to cause them to become generate industrial money to help you credit-worthwhile rural borrowers.

The fresh new USDA even offers several private credit software beneath the OneRD umbrella, together with Team & Business (B&I) Funds, Area Business (CF) Money, Rural Time to have The usa System (REAP), and you may Liquid & Waste Fingertips Program (WWD), and others.

Of numerous services result in the USDA Rural Creativity program therefore appealing to rural business owners, none more pleasing compared to number of firms that normally gain benefit from the money because of the wider-centered eligibility standards

So it starts with the newest wider geographical availability of the newest financing. As keyword, rural you are going to 1st lead you to believe that geographical qualification can be a bit limited and you can limiting, the USDA describes rural because the one area or urban area having 50,000 or fewer customers. Which means more 97% of the many American towns and cities. Concurrently, enterprises with headquarters in huge area elements also are qualified, so long as the real part, department, otherwise operation is found in this a rural area.

- For-finances people

- Nonprofit teams

- Established companies

- The fresh new Businesses / Startups

- Somebody, partnerships, and you will co-ops

- Franchises

- In public traded organizations

- Public bodies and you can crucial society institution

- Federally recognized Indigenous American tribes

Most people are along with surprised to discover that Rural Invention Company & World money aren’t limited to farming spends. Any kind of particular big or small business can use to have money.

Only a few company brand of any size aren’t eligible for Rural Creativity B&We Funds otherwise financial support from of their sis applications around the new OneRD umbrella, and churches, gambling enterprises, rental property, and you may some anyone else. However for by far the most region, brand new greater geographic availability and a general listing of qualified company sizes and uses enable an enormous universe from potential consumers.

Whether or not a little established mommy-and-pop business, a media-sized business, otherwise a giant organization seeking to expand, and get otherwise launch a new section from inside the an outlying town, are all permitted sign up for financing, provided it meet most other qualifying requirements. Including creditworthiness (credit rating of 680 or maybe more and you can an excellent fee background), enough collateral (bucks, home, or any other tangible property lay at a marked down worthy of for the an effective 1:step one base into questioned amount of the mortgage), in addition to capacity to repay the borrowed funds, among added standards.

The fresh versatility out of Rural Development Money having businesses of all groups and you can products is even shown throughout the few offered loan numbers perhaps one of the most vision-swallowing popular features of the program. Financing can range away from as little as $1 million around $twenty-five billion getting B&I Finance ($forty million without a doubt rural co-ops), $twenty five billion having Experience Money, and you may $50 mil to own WWD Finance, and you may $100 million to possess CF Fund. In comparison, SBA seven(a) money max away at just $5 Billion.

Loan terms are dependent upon suggested fool around with but basically range between seven years to possess working-capital so you can fifteen years having gadgets, 30 years for real property, and up in order to forty years to own Area Institution Fund. Interest rates also are extremely competitive, linked with the new Wall surface Road Diary Prime Price. Maximum financing guarantees are set because of the private lender. Extremely B&We Finance approved by Northern Method Financing on the financial year 2021 gotten an enthusiastic 80% make sure.

North Method Financing try America’s #step 1 USDA Outlying Innovation Business & Globe Financing bank

Whether or not you are a little or higher company, a new or established that, for-earnings loans Fort Rucker AL otherwise nonprofit, the newest USDA Outlying Advancement Financing System even offers a superb chance for the industrial financial support need.

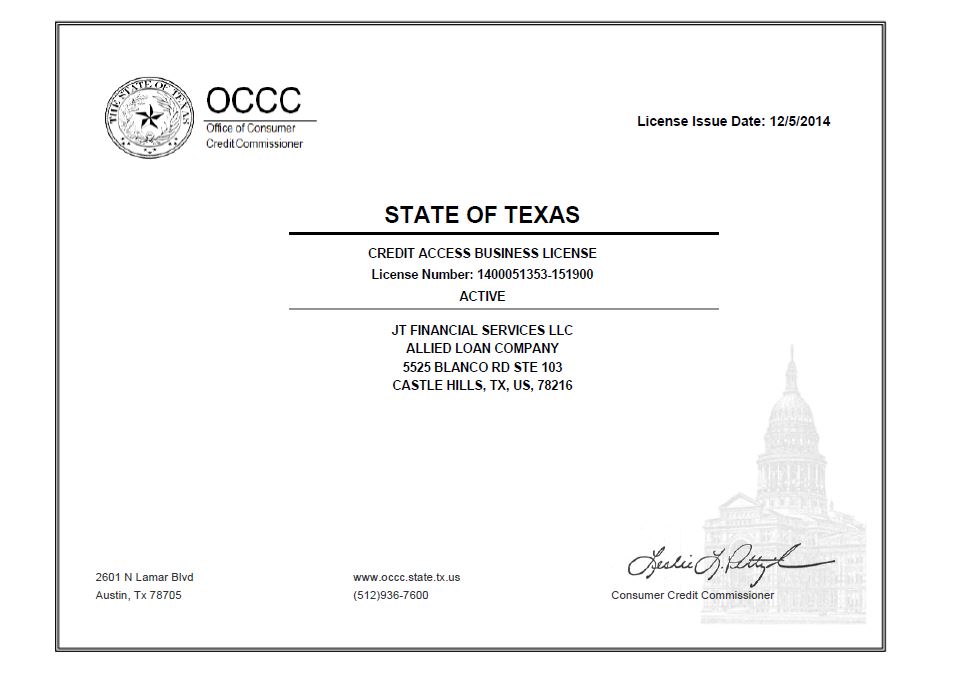

To learn more about obtaining an effective OneRD Financing to aid having your online business, contact a group member on North Path Funding. Given that state’s #1 provider regarding USDA Company & Industry Money, i have workplaces inside the Northeast Fl, Las vegas, Arkansas, Georgia, Tennessee, and you may Texas and you can partners in every 50 claims to simply help facilitate fund. Start, now!