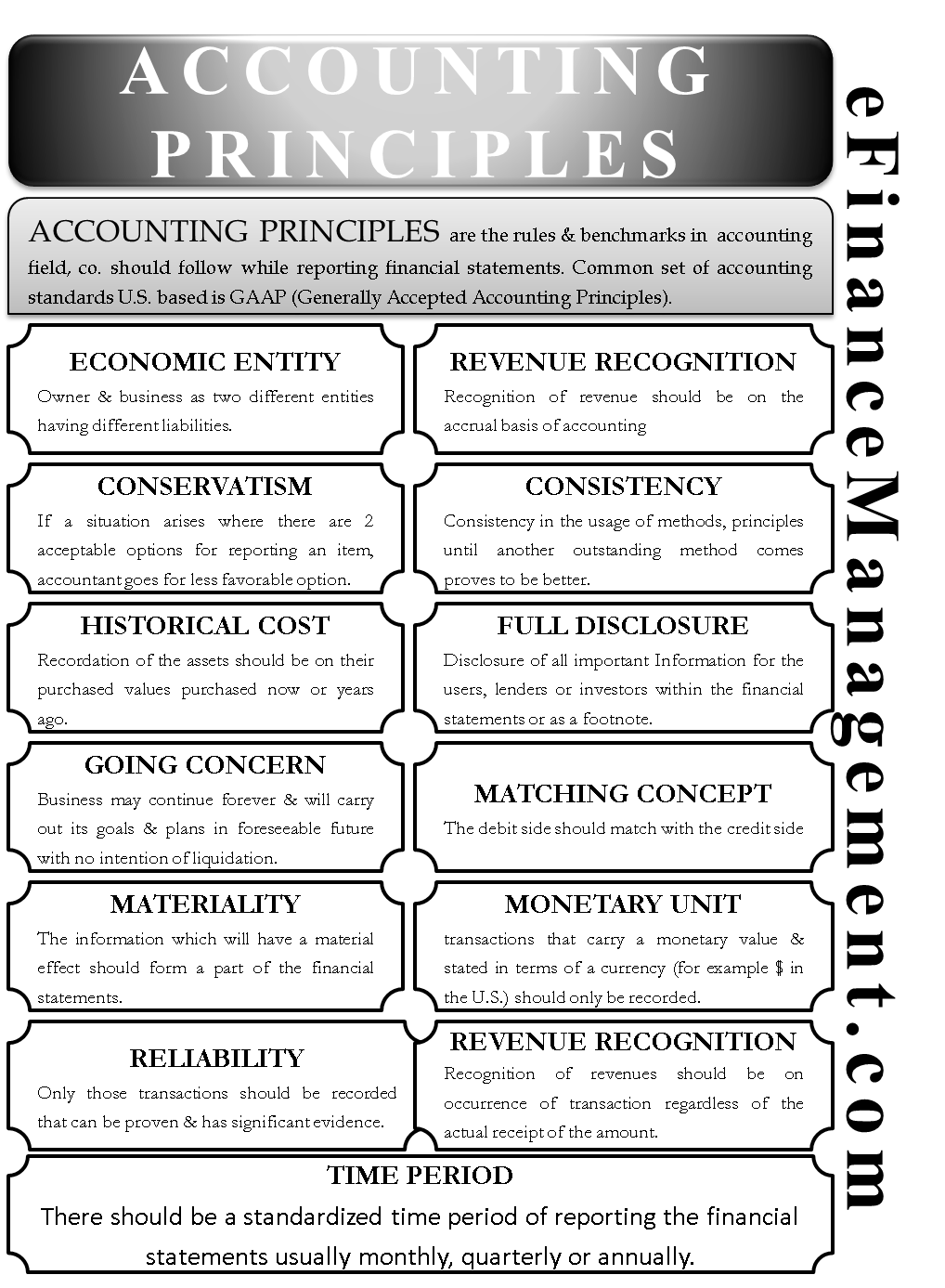

Using this accounting principle, then, your accountant will be more likely to anticipate losses in your reports, but not revenues or profits—hence they’re being more conservative with the business’s financial success. Moreover, this accounting principle also dictates that if an accountant thinks—based on a business’s financial statements—that they’ll be forced to liquidate, they must disclose this assessment. This accounting principle helps ensure that stockholders, investors, and even the general public are not misled by any aspect of a business’s financial reports. At his first meeting with Marilyn, Joe asks her for an overview of accounting, financial statements, and the need for accounting software. Based on Joe’s business plan, Marilyn sees that there will likely be thousands of transactions each year. She states that accounting software will allow for the electronic recording, storing, and retrieval of those many transactions.

About the Book

Members of the public can attend FAF organization meetings in person or through live webcasts. Integrity Network members typically work full time in their industry profession and review content for Accounting.com as a side project. All Integrity Network members are paid members of the Red Ventures Education Integrity Network. Accounting.com is committed to delivering content that is objective and actionable. To that end, we have built a network of industry professionals across higher education to review our content and ensure we are providing the most helpful information to our readers. We believe everyone should be able to make financial decisions with confidence.

Going Concern Assumption

For newer instructors however it may be a bit daunting to distill the content down to what is most essential to cover in an introductory course. The text has some content that is more relevant to courses such as Accounting Information Systems, Financial Management, and Intermediate Accounting. If an instructor’s principles course contained only students who quickly and easily understood accounting concepts, then it would be possible to touch on such a wide variety of concepts in an introductory course. However, most principles courses contain business majors and other non-accounting majors who would struggle with the pace required to cover so much material. The conceptual framework sets the basis for accounting standards set by rule-making bodies that govern how the financial statements are prepared. Here are a few of the principles, assumptions, and concepts that provide guidance in developing GAAP.

Fundamental Accounting Concepts and Constraints

The separate entity concept prescribes that a business may only report activities on financial statements that are specifically related to company operations, not those activities that affect the owner personally. This concept is called the separate entity concept because the business is considered an entity separate and apart from its owner(s). The cost principle, also known as the historical cost principle, states that virtually everything the company owns or controls (assets) must be recorded at its value at the date of acquisition.

In simple words, an organization should not waste its time on immaterial facts that do not help in determining its income for the period. In order to differentiate a fact as material or immaterial, one should consider its nature and the amount involved. Therefore, a fact will be considered material if the accountant believes that the information can influence the decisions of a user of the financial statements.

Governmental Accounting Standards Board

Some companies that operate on a global scale may be able to report their financial statements using IFRS. The SEC regulates the financial reporting of companies selling their shares in the United States, whether US GAAP or IFRS are used. The basics of accounting discussed in this chapter are the same under either set of guidelines. As you may also recall, GAAP are the concepts, standards, and rules that guide the preparation and presentation of financial statements. If US accounting rules are followed, the accounting rules are called US GAAP.

He has held the office of vice president of the American Accounting Association and served on its Executive Committee. He was also a member of the Institute of Management Accountants, the American Institute of Certified Public Accountants, and the Financial Executives Institute. I did not notice a specific attempt to include a variety of backgrounds, although that can be somewhat difficult to include in accounting problems/scenarios without it seeming very forced.

- Each chapter has the same structure making it easy for students to get in the flow.

- In simple terms, for accounting purposes, the business and its owners are treated separately.

- We all know that this is not really correct because inflation continuously erodes the value of monetary units.

- Along with several other principles, this serves to maintain an ethical standard and responsibility in all financial dealings.

- Accountants use multiple formats when creating balance sheets including classified, common size, comparative, and vertical balance sheets.

In other words, you’re always reporting the historical cost of the asset or item. As noted, I like the fact they are introducing accounting information what is the adoption tax credit systems which is an important topic. The text covers all the important aspects that should be covered in the introduction to financial accounting.

She has worked with other small business owners who think it is enough to simply “know” their company made $30,000 during the year (based only on the fact that it owns $30,000 more than it did on January 1). Those are the people who start off on the wrong foot and end up in Marilyn’s office looking for financial advice. With thousands of such transactions in a given year, Joe is smart to start using accounting software right from the beginning. Accounting software will generate sales invoices and accounting entries simultaneously, prepare statements for customers with no additional work, write checks, automatically update accounting records, etc.

The financial statements are meant to convey the financial position of the company and not to persuade end users to take certain actions. Accounting principles are rules and guidelines that companies must abide by when reporting financial data. Which method a company chooses at the outset—or changes to at a later date—must make sound financial sense. Privately held companies and nonprofit organizations also may be required by lenders or investors to file GAAP-compliant financial statements.